Architecture is famous, at least for now. Maybe it’s the titanium museum, maybe the Target teapot and housewares. Architects have always been favorite protagonists for television writers from “Once and Again” back to “Mr. Ed.” Today, real-life architects proliferate, sitting for talking head interviews and posing for Jockey underwear ads. The Los Angeles Times even has a weekly real estate gossip column breathlessly namedropping Hollywood personalities and their designers. Everybody wants an architect, wants to meet, show off, or even be one, or wants some kind of piece of one—if not a house, then a plate, a poster, the teapot….

“Architect.” The definition has thinned with overexposure. In a cheesy bid for borrowed dignity, the general press and unrelated disciplines have appropriated the word: “Foreign Policy Architect,” “Information Architect,” “Software Architect,” etcetera. Nevertheless, good design is celebrated, and the contribution of the “Architect” is more widely than ever understood to add value to a product or a building. Nowhere is this more apparent than in residential real estate.

Selling Architecture

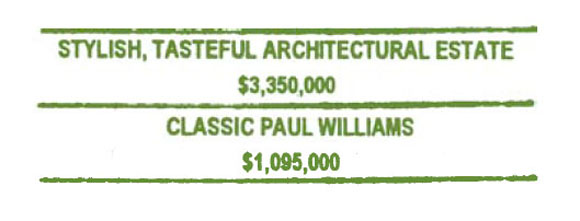

Several California real estate firms boast “Architectural Properties” and feature architects’ names prominently in advertising.

One Sunday ad audaciously blithers about a “dramatic Lautner style contemp….” The late architect would rightly cringe—or sue. Cleverly inverting the dictum about the promise of wealth in “underestimating the intelligence of the American public,” one realtor who actually understands design warns it’s “not possible to get rich just selling architecture.” Maybe not, but the promotion of architect-designed houses as a specialty by increasingly monopolistic house-selling mills is evidence of an important market share.

Respondents to these “architectural house” ads articulate many of their house-buying criteria in identical terms: Price, of course; Number of bedrooms and baths; Location (near the studios, near the beach, near houses of worship); Geography (the hills or the flats); Views (city lights, canyon, ocean). But the architecture component of a wish list distinguishes the prospective homebuyers from one another as well as from the general home-buying public:

Architecture Buyers

✤ The Label Buyers: Budgets vary. Like buyers of label clothing, they seek a comfort level in name brands to compensate for lack of personal expertise. Typical quote: “Do you have any Nootra’s?”

✤ The Trophy Seekers: Label Buyers, but with more money and time. Acutely aware of famous or fashionable architects. Often Trophy Seekers have trophy vehicles, trophy spouses, other trophy houses. Sometimes famous themselves. Typical quote: “My Neutra was in much better shape.”

✤ The Architecture Groupies: Needs often exceed budget. Frequently knowledgeable, they use the real estate pages as a kind of architecture tour guide. Typical quote: “This isn’t his best. Did you see that Neutra two years ago in the Valley?”

✤ The Too Rich: Budget often exceeds needs. As money is no object, they help to drive prices beyond the reach of others and can be cavalier in their treatment of landmark-quality houses. Like landed nobles of yore, many have a fondness for properties at higher elevations. Typical quote: “Is it gated?” Also: “Is there room for a (tennis) court?”

✤ The Restorers: Realistic approach to budget. True believers, respectful of the architect’s intentions and admirable in their desire to revive, with authenticity, the essential qualities of whatever it was. Typical quote: “This is so cool. I wonder if we can match the tile?”

✤ The Sc-rapists: Opportunistic developers who buy and tear down sometimes serviceable, sometimes historic buildings to “maximize” the financial yield of a property with new structures usually excessive in lot coverage, square footage, and profile. Cold blooded in their disregard for the physical and cultural landscape. Typical quote: “This is a tear-down. It doesn’t make any sense at this price. The site’s okay but the house is garbage. I’m just going to scrape it (off the face of the earth).”

✤ The Oblivious: Dialed the wrong number or wandered into the wrong open house. Just need three bedrooms and two baths. Typical question: “Why is this priced so high? Is the plumbing new?”

All but the last two of these buyer-prospects have one thing in common: they pay extra for architecture (at least they would if they could). So, as in the recently hyperactive real estate market, they keep the inventory tight and prices relatively robust.

Architecture, then, isn’t just a marketing tool. It is a true component of the worth of a house.

The Value of Architecture: Rewards

So, the abiding if redundant holy trinity of real estate value, “Location, Location, Location,” works in counterpoint to the Vitruvian trio, “Strength, Commodity and Delight.” Some real estate appraisers, upon whom lenders depend in determining loan amount and suitability, will boost their assessment of a property five or ten percent to account for extraordinary architecture.

When such a house is sold, the architecture premium rubs off on nearly every player in the game and some, like the city and county governments, who simply provide the venue.

For combing multiple listings to match up people and property (creation isn’t the only endeavor that’s a patient search) and negotiating and documenting the ensuing deals, buyer’s and seller’s real estate brokers usually divvy up between them five or six percent of the sales price. For identifying and insuring against liens and other “clouds,” the title company charges several cents per thousand dollars of the sales price. For acting as a neutral intermediary holding and disbursing funds, the escrow firm charges around a dollar or two per thousand of the sales price. Home warranty policies frequently purchased for buyers can cost five hundred dollars or more. Cities collect various taxes upon each property ownership transfer, and the county annually assesses one and a half percent of the most recent sales price. The seller, of course, gets the remaining proceeds. (And, the buyer gets to live in the house.) If the house sells again in ten years, or five, or two, all involved reprise their roles, and their income.

But not the architect. After the initial, sometimes hard-won client fee, there is only reputation. Accountants call this “good will in the marketplace.” Like the architect’s stock-in-trade, talent, it is not fungible.

So much for rewards.

What about the work, the architecture? What about the creative, analytical, evocative efforts of those architects living and (as with so many in public favor) dead. A case in point:

The Value of Architecture: Respect

The heirs of a well-known and respected Los Angeles architect put their childhood home up for sale. The principal of an international firm, the architect designed his only small-scale residential work for his own family in 1959. In this way, as well as in many of its design features, the post-and-beam home on a secluded acre of land in a canyon above Beverly Hills was unique, and was recognized as such in text and photographs by several publications of its day, including Architectural Record and Arts and Architecture.

With families and homes of their own, the heirs had no use for the house but did have the very pragmatic requirement to maximize the proceeds of its sale. Believing they were entrusted not just with their own legacy but that of the design community, they preferred that the house be preserved. But with no legal or societal imperative to underpin this wish, a wish it might remain. Could a buyer be found within a reasonable timeframe who would respect the architecture?

Supply-and-demand is the rule in property as in commodities, evidenced by the common real estate lore which holds “the market sets the price,” or anyway the price range. (To many practitioners, the market is a living, or at least a speaking, entity. The market “will tell you” if your price is too high.) Within the range, though, the price can to a certain degree influence the fate of a house. With a price set beyond the pencil-out reach of serious sc-rapists, advertising for the “One-of-a-kind Post-and-Beam” attracted an initial group of about a hundred realtors and prospective buyers, which quickly yielded one “qualified,” which is to say high-paying, bankable buyer.

The price-setting dodge doesn’t always work—not with The Too Rich. The ultimate disposition of the house in question remains uncertain. The new owner was heard contemplating an addition to the property of a tennis court and servants quarters, as well as general remodeling intended to convey “a Japaneezy, Zen sort of feeling.”

So much for respect.

A thoughtful Los Angeles architect said not long ago that after serious consideration he rejected the opportunity to buy a house designed by Rudolph Schindler, because he realized the house was better suited to someone more comfortable with the responsibility—and the constraints—of what he called “stewardship” of a masterpiece. If only such ethical restraint were widespread, the work might endure.

Fruits of the Architect’s Labor: Re-Slicing the Pie

A house is usually designed under a contract between architect and owner. The resulting building is what lawyers call a “work for hire.” The original client and subsequent holders of the property deed own the right to keep or dispose of the house any way they see fit. The architect is left with a booby prize: ownership of the drawings. Copyright protected drawings can’t legally be copied, even by their originator. A New York apartment building owner sued his architect and the developer of a subsequent building which reused elements of the architect’s earlier plans. The winning premise was that the second building diminished the uniqueness, and thus the market value, of the plaintiff’s building. Simultaneously, the case proved the value of the creative labor and limited the architect’s participation in its fruits.

Screenwriters can share in profit “points” of their films, actors receive residuals for repeat broadcasts of programs and commercials, recording artists can participate in income from album sales. What if every time a house sold, the architect got a cut? What if the work were protected by deed restriction, by covenant, by contract, or by easement in ways clearly beneficial instead of confiscatory? What would be the results, in terms of rewards and respect, for architecture, for architects, and for everyone?

Before architecture, before law, before fame and popular culture, before money, when wealth was measured by, maybe, sloth pelts…. In those days a warm dry cave within walking distance of a good fishing hole was valuable real estate.

Now along comes the creative individual with the notion to cut a few branches or move a boulder so the fishing hole can actually be seen from the property.

The idea is worth an extra pelt.

Author Erik Lerner, AIA, practiced architecture from 1982 until 1997, when he joined Mossler Deasy & Doe, a Beverly Hills-based real estate brokerage that has specialized for 24 years in representing buyers and sellers of architect-designed houses.

Originally published 2nd quarter 2001, in arcCA 01.2, “Housing Complex.”